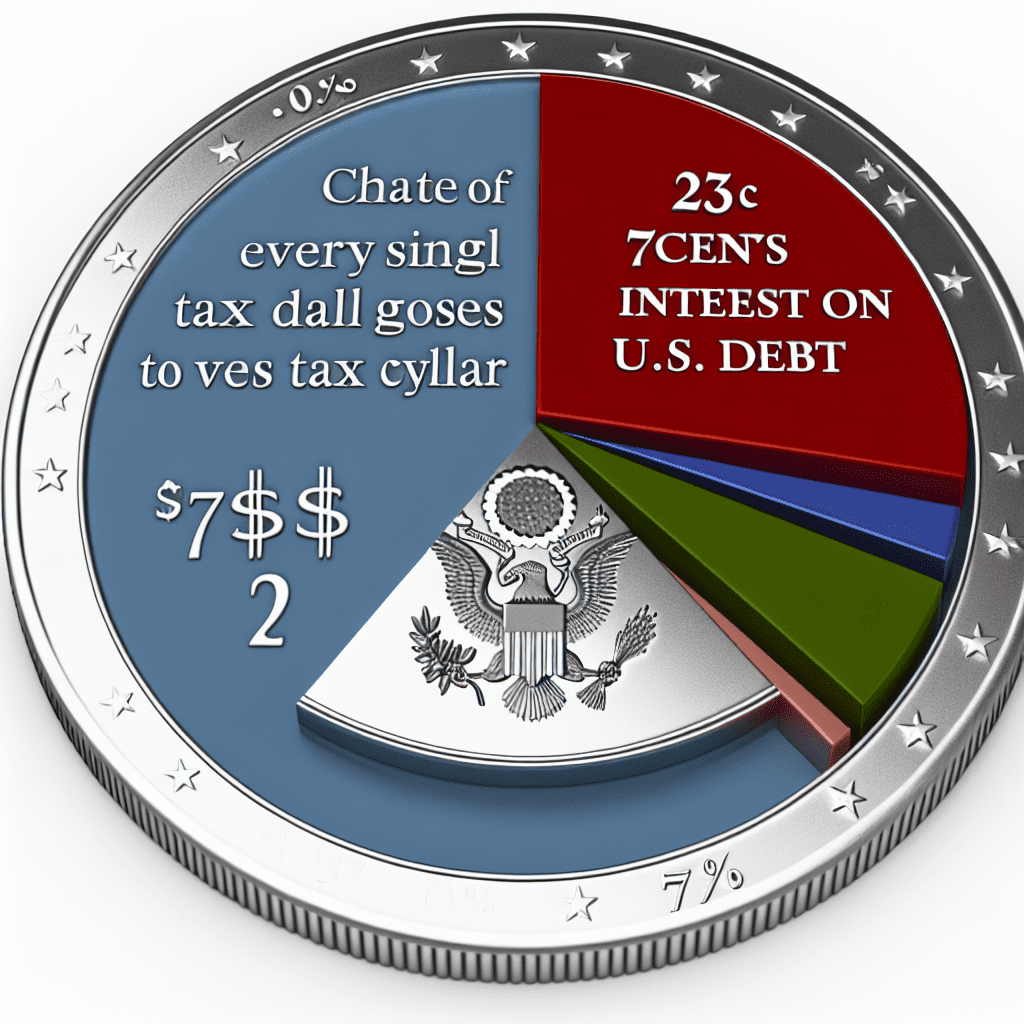

The United States finds itself on the edge of a financial crisis. With the total U.S. debt exceeding $37.43 trillion as of September 2025, the country is facing a challenging reality. Almost 25% of every tax dollar collected goes towards servicing its debt’s interest payments.

The relentless rise of U.S. debt

Recent monthly updates from the U.S. Treasury and the Joint Economic Committee report that the national debt has surged to $37.43 trillion, reflecting an increase of $2.09 trillion in just one year.

Interest payments for FY2025 have already surpassed $478 billion year-to-date, marking a 17% rise from the previous year, as reported by CNBC.

This cost is expected to take up about 23 cents of every dollar the IRS collects in revenue. This proportion has escalated sharply as global interest rates return to normal following years of quantitative easing.

Tariffs: impressive figures, minimal effect

In recent years, the U.S. government has generated record-breaking revenue from tariffs, particularly following the imposition of new import duties during the Trump era.

These tariffs are anticipated to enhance Treasury revenues, potentially decreasing the national deficit by $4 trillion over the next decade.

However, even such revenue streams barely address the towering national debt, as rising interest expenses negate the gains from tariff collection. The IMF has warned about the “highly uncertain” scale of the increase in tariff revenue, while Eliant Capital noted:

“Despite tariff revenues, the deficit for July was $291B with the U.S. spending $630B and collecting $338B meaning 46¢ was borrowed for every $1 spent.”

Nothing halts this momentum

Macro analyst Lyn Alden has brought attention to the “nothing stops this train” theory, a phrase derived from pop culture that has become emblematic of the U.S. debt crisis.

Alden argues that ongoing deficits and unending spending create a landscape of fiscal dominance, making substantial fiscal reform politically improbable. In her view, the continuous accumulation of debt is inherently embedded within the system, and only a significant shift (like transitioning to hard money) can break the cycle. Alden stated to Slate Sundays:

“Structurally, U.S. debt is growing above target almost without a means to halt it.”

The Peterson Foundation reveals that interest payments have now become the third-largest expense category in the federal budget, eclipsing nearly all other programs besides Social Security and Medicare.

By year-end, federal interest payments are projected to account for 18.4 percent of total revenues, a level not seen since the early 1990s.

As interest payments claim an increasingly larger share of federal funds and traditional solutions like tariffs and budget cuts fall short, discussions around “hard money” gain traction.

Bitcoin and other cryptocurrencies are being increasingly regarded as viable alternatives for preserving value during a phase of ongoing monetary expansion.

As Alden’s thesis suggests, nothing is stopping this trajectory, and this awareness is driving renewed interest in hard money options, such as Bitcoin and gold.

Investors look for alternatives like Bitcoin and gold

Both gold and Bitcoin have experienced robust demand as alternative stores of value amid economic concerns and inflationary pressures.

By mid-September 2025, gold had reached an all-time high, trading above $3,600 per ounce, an increase of over 41% year-on-year.

Some analysts predict that gold’s ascent will persist, with forecasts suggesting prices could rise to $3,800 by the end of the year as global liquidity worries push investors toward safer assets.

Bitcoin, often referred to as “digital gold,” is trading between $115,000 and $118,000, having recovered from its lows around $108,000 in September.

While Bitcoin’s price has shown volatility, many analysts, including Lyn Alden, foresee it reaching at least $150,000 by the end of this cycle.

As fiscal challenges escalate, these alternatives are increasingly recognized as essential components of diversified investment portfolios, particularly during a time when U.S. debt is spiraling out of control.