XRP surged to $1.87 as the supply held by exchanges declined to its lowest since 2018, reinforcing a narrative of tightening supply, even though prices remain below the significant $1.88–$2.00 resistance band that has consistently hindered recoveries.

News background

Exchange balances have become a critical indicator once more. The supply on trading platforms has dropped to approximately 1.6 billion XRP, marking a 57% decrease since October, implying that more tokens are being transferred to long-term storage or custody rather than being readily available for sale.

This decline is occurring amidst a broader trend of selective positioning across major assets: institutions are increasingly relying on structured and regulated frameworks for exposure while spot markets remain volatile, leaving tokens like XRP supported by a long-term demand but exhibiting fragile short-term momentum.

For XRP, the reduction in exchange inventory is significant because it can magnify price movements when demand increases — but it does not ensure price rises if sellers appear at known technical thresholds (the $2 level has consistently been that threshold).

Technical analysis

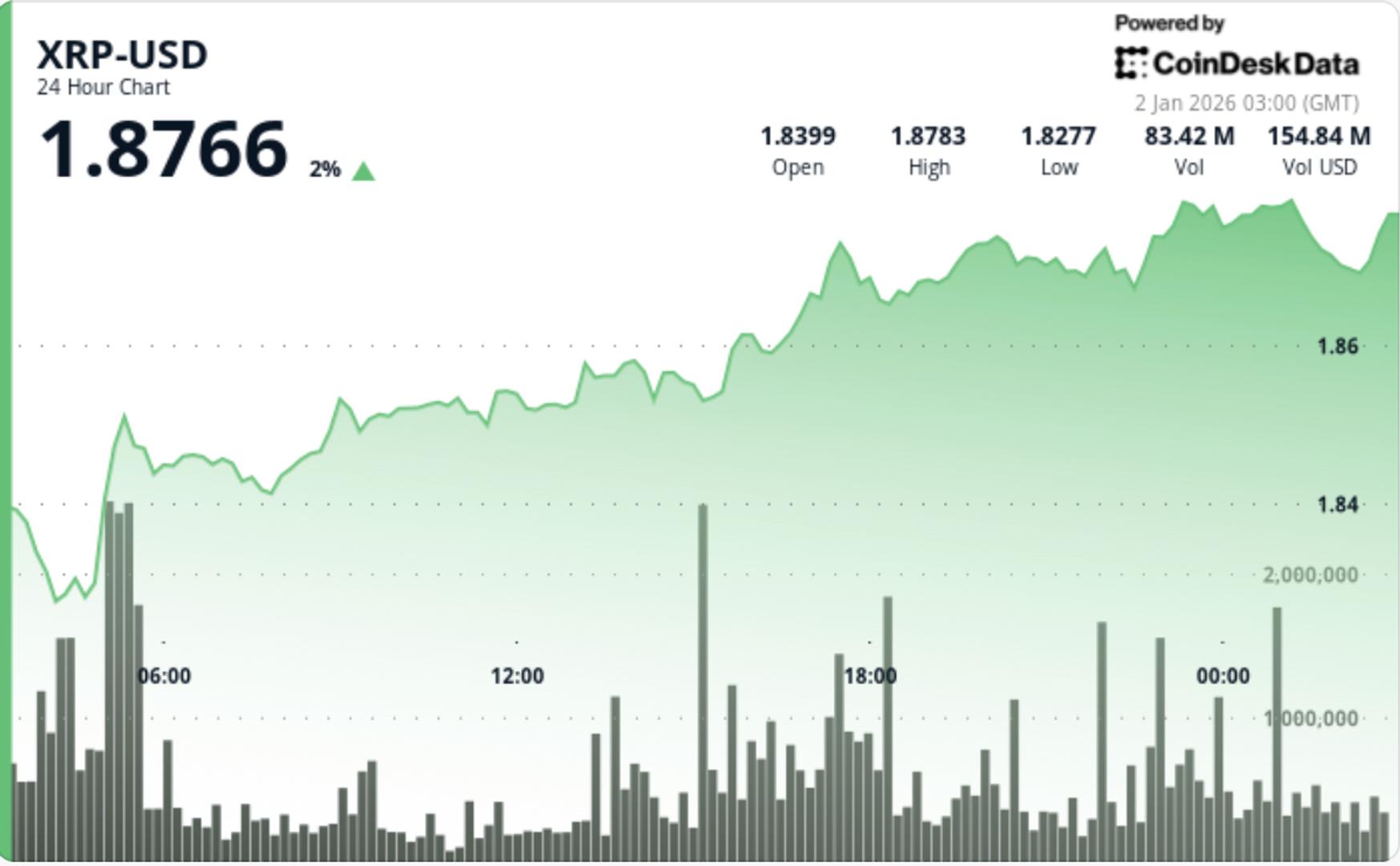

XRP experienced a rise of about 1.7% from $1.84 to $1.87, marking a series of higher lows throughout the session while maintaining a relatively stable $0.05 trading range (approximately 2.5% intraday volatility). Participation improved at a crucial moment: volume surged during the upward move (around 32 million, about 50% above average) — indicating this wasn’t merely a drift upward due to thin liquidity.

However, the overall sentiment still reflects a controlled recovery within a larger resistance zone. XRP repeatedly slowed as it neared the $1.88 mark, which coincides with a wider resistance area leading up to the psychological barrier of $2.00. This is important because recent attempts to surpass $2 have been swiftly rejected, making this area a supply zone where sellers are comfortable capitalizing on rallies.

Momentum indicators present a mixed reading. Some oscillators indicate bullish divergence (momentum improving even with price not fully breaking out), but the market requires follow-through above resistance to confirm this trend. On the downside, the structure remains positive as long as XRP stays above the $1.82–$1.83 foundational level observed in early trading sessions — and more broadly above the $1.77 support level that has historically acted as a demand zone.

Price action summary

- XRP increased from $1.84 to $1.87, achieving a continuous series of higher lows

- Volume surged during the upward movement, hitting around 32M, which is approximately 50% above average

- Price stalled near $1.88 resistance, maintaining the broader $1.77–$2.00 range

- Late-session activity consolidated around $1.873, indicating a potential inflection point rather than a breakout

What traders should know

The current dynamic is a balance between decreasing available supply and a firmly established resistance ceiling.

Key levels are clearly defined:

- Bull case: A sustained break above $1.88 could lead to a move toward $1.95, with $2.00 acting as a breakout point. A successful reclaim of $2 would likely attract momentum buyers and compel repositioning from sellers defending that area.

- Bear case: Inability to hold the $1.82–$1.83 base shifts focus back to $1.77, the next significant demand level. If that level is broken, the risk extends lower into the broader support region (where buyers historically reenter), but the immediate battleground clearly exists between $1.77 and $1.88.

For the time being, the declining exchange supply maintains a favorable long-term outlook — but the market needs a decisive breakthrough above $1.88–$2.00 for the upward narrative to seize control.