Important Updates

- Pantera plans to raise $1.25 billion to establish Solana Co., enhancing Solana’s business footprint.

- Pantera commits $300M to Digital Asset Treasuries, aiming to expand blockchain assets.

- Solana Co. may position Pantera as the leading public holder of Solana coins.

Pantera Capital Targets $1.25 Billion Solana Fund, Potentially Making it the Largest Corporate Holder of Solana Coins

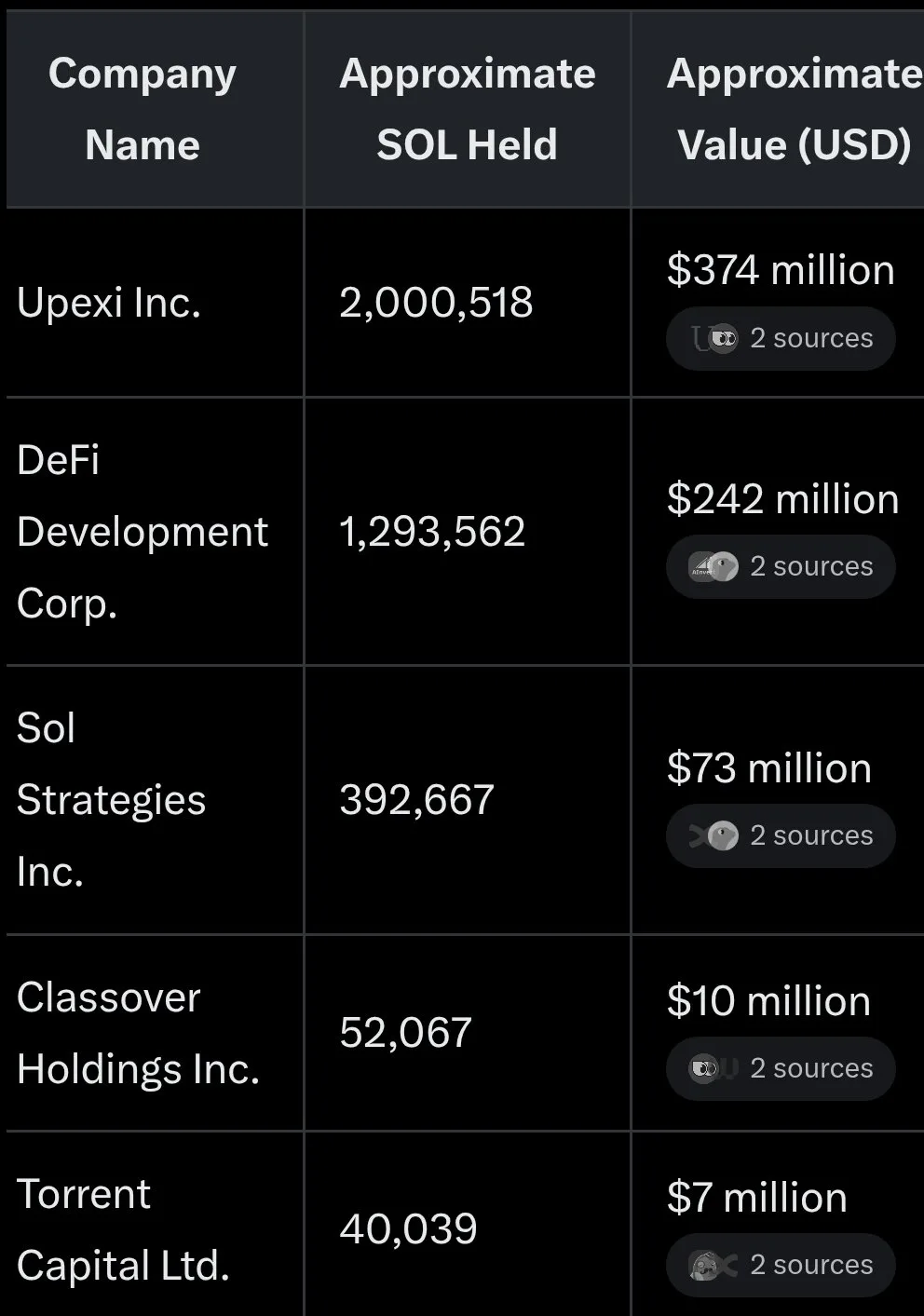

Investment powerhouse Pantera Capital is reportedly working on establishing a new entity called Solana Co., with aspirations to raise up to $1.25 billion. This new venture aims to serve as a publicly traded reserve asset for the Solana blockchain. Should this initiative come to fruition, Solana Co. could establish itself as the top corporate holder of Solana coins, outpacing other public entities.

As reported by Decrypt, referencing information from The Information, Pantera Capital is looking to raise this substantial amount through a two-phase capital increase. The first phase aims for $500 million, followed by an extra $750 million through token warrants.

The announcement indicates that this transaction could signify a notable advancement for Solana in the cryptocurrency landscape, allowing Pantera to solidify its status as a key player in the blockchain arena.

Pantera Capital’s Ambitious Strategy: $1.25 Billion for Solana Co.

To broaden its portfolio, Pantera is setting up Solana Co., which stands to become the largest corporate stakeholder of Solana.

- Phase 1: Raising $500 million

- Phase 2: An additional $750 million through token warrants

- Future Goals: Establishing Solana as a long-term reserve asset

A Transformative Step for Solana

Besides the potential $1.25 billion capital raise, Pantera Capital has significantly invested in Digital Asset Treasuries (DATs), aimed at optimizing cryptocurrency storage for value and profitability. In August 2025, Pantera allocated $300 million into DATs. These investments are focused on enhancing the long-term appeal of the associated tokens.

Pantera’s DAT portfolio encompasses not only Solana but also other leading cryptocurrencies like Bitcoin and Ethereum, alongside investments in promising firms such as Twenty One Capital, DeFi Development Corp, and Sharplink Gaming.