Recent reports indicate that 16 wallets acquired 431,018 Ether from September 25 to 27, with a total expenditure of approximately $1.73 billion. These purchases involved notable entities such as Kraken, Galaxy Digital, BitGo, FalconX, and OKX.

Related Reading

This significant accumulation has reignited discussions about who is seizing the opportunity to buy during price dips and why larger investors appear eager to increase their positions while market prices fluctuate.

Exchange Balances Decline to 9-Year Low

Data from Glassnode reveals that the quantity of ETH stored on exchanges has decreased from approximately 31 million to about 14.8 million ETH — a 52% decline from levels seen in 2016.

Many of these coins are likely locked in staking contracts, cold storage, or held by institutional custodians. The recent introduction of the first Ethereum staking ETF has further contributed to reducing supply on exchanges.

With fewer coins available on exchanges, instant selling capacity diminishes, which can lead to more pronounced price movements when substantial orders are executed.

ETH Stabilizes Around $4,000 Amid Increasing Volatility

According to TradingView analytics, ETH is trading approximately at $4,011, reflecting a slight decline of about 0.33% in the last 24 hours and over 10% over the past week.

The token briefly dipped below $3,980 during the session before rebounding, and it remains less than the recent mark of $4,034.

This two-week retreat has brought ETH back to a crucial $4,000 support zone, with short-term fluctuations growing more pronounced as holders adjust their positions.

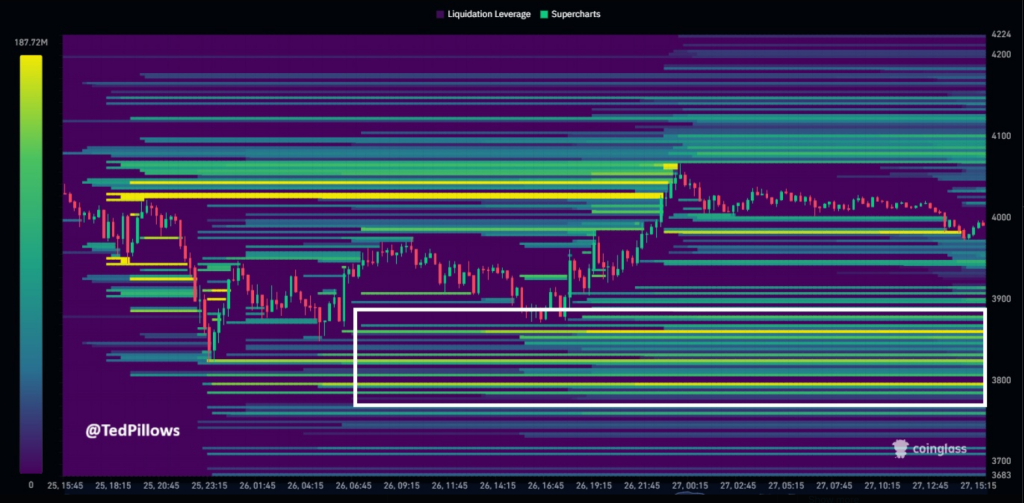

$3,700 Represents a Critical Threshold

Crypto analyst Ted Pillows has cautioned that the $3,700 to $3,800 range could encounter substantial pressure. Reports suggest that if ETH falls beneath $3,700, numerous margin positions might be liquidated, potentially triggering forced selling that would drive prices downward.

$ETH liquidity heatmap indicates significant long liquidations near the $3,700-$3,800 level.

This level may be revisited before Ethereum shows signs of recovery. pic.twitter.com/SQTbfrujAa

— Ted (@TedPillows) September 27, 2025

With reduced coin availability on exchanges and heightened margin risk, the short-term outlook remains precarious, despite solid indicators for long-term demand.

ETF Outflows Indicate Shifting Institutional Sentiment

ETH funds listed in the US experienced nearly $800 million in outflows this week, marking their biggest redemptions to date. Nonetheless, about $26 billion still resides in Ethereum ETFs, which accounts for 5.37% of the total supply.

Whales continue to accumulate $ETH!

16 wallets have received 431,018 $ETH ($1.73B) from #Kraken, #GalaxyDigital, #BitGo, #FalconX, and #OKX in the last 3 days. https://t.co/0DPxgZMGN7 https://t.co/xtPLBKo9LZ pic.twitter.com/oEXZKIErmr

— Lookonchain (@lookonchain) September 27, 2025

Related Reading

These figures highlight the speed at which institutional sentiment can shift: large inflows can disappear just as rapidly, and ETF flows now represent a significant new factor in price dynamics.

Lookonchain data also revealed prior accumulation of roughly $204 million in ETH, reflecting similar trends of significant players stepping in during market dips.

Retail traders seem more cautious for the time being. However, the recent wave of substantial purchases by institutional-grade custodians indicates some buyers are perceiving dips as buying opportunities, while others prefer to remain on the sidelines.

Featured image from Unsplash, chart courtesy of TradingView