Disclosure: The opinions expressed here are those of the author and do not necessarily reflect the views of crypto.news’ editorial team.

What an incredible era we find ourselves in! Bitcoin (BTC) is thriving, and opportunities to earn more are everywhere.

Summary

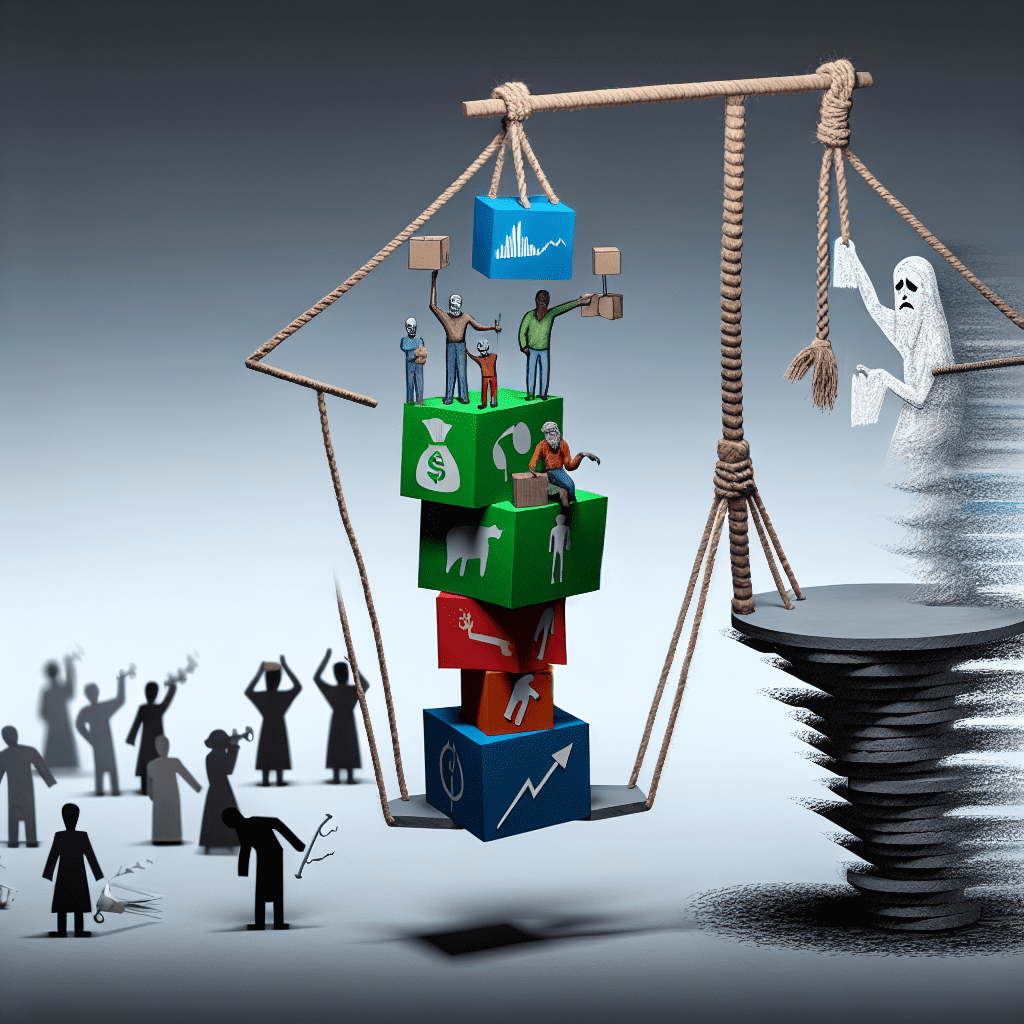

- The attraction and danger of centralized crypto — Major exchanges, lenders, custodians, and payment platforms prevail today, but history reveals that “Too Big to Fail” entities, both in crypto and traditional finance (TradFi), often meet a dramatic downfall.

- History of disasters — FTX, Terra/LUNA, Celsius, 3AC, and Mt. Gox have all incurred immense losses due to mismanagement, over-leveraging, hacks, or fraud, all heightened by centralization and a lack of transparency.

- TradFi parallels — The 2008 financial crisis and Enron’s fall echo the failures seen in crypto, demonstrating that accumulation of power without transparency poses an ongoing threat.

- A warning for BTC holders — “Not your keys, not your coins”: retain your assets on decentralized blockchains, carefully assess yield-earning platforms, and never presume that disaster won’t strike again.

The main beneficiaries of this amazing era are the major players. You’re likely aware of who these major players are — centralized cryptocurrency exchanges, lending and borrowing platforms, custodians, and payment transfer systems. If you’re involved in crypto investing, it’s quite possible that one or more of these major players are currently holding your funds.

You might not view this as a concern. These centralized firms control billions in assets and are strongly backed by well-known investors and other reputable stakeholders, enhancing their public image. Moreover, they generally require less expertise than decentralized alternatives, offer fiat-to-crypto conversion services, and can act as a comprehensive solution for your cryptocurrency needs.

Sounds… pretty appealing, doesn’t it?

Yet, it’s dangerous to forget past lessons. Cast your mind back a few years, or even decades, and you’ll find some of the most significant calamities in crypto history came from entities many would have labeled Too Big to Fail. Just as the so-called Too Big to Fail banks caused chaos for everyone from institutional investors to average citizens during the 2008 financial crisis, centralized crypto firms have brought about disaster after disaster.

And this will occur again. And again. And again.

Don’t remember the collapses that highlight the risks of relying on centralized (as opposed to decentralized) entities for your BTC? Here’s a concise review:

FTX / Alameda Research Collapse

Centralization failure: FTX, previously the world’s third-largest centralized crypto exchange, failed in 2022 due to improper use of customer funds, insider trading, and questionable leverage practices involving its FTT token and the crypto trading firm Alameda Research. Both FTX and Alameda were under the ownership of the same individual (Sam Bankman-Fried), who is now serving a 25-year sentence.

Amount lost: over $8 billion.

Terra / LUNA Stablecoin Collapse

Centralization failure: The TerraUSD stablecoin depended on algorithmic pegging via LUNA tokens instead of a decentralized approach incorporating safer collateral designs and transparent governance and audits. This led to a significant sell-off for LUNA during the 2022 market downturn, resulting in the demise of TerraUSD and the failure of several other large, centralized entities involved in risky, opaque practices.

Amount lost: approximately $45 billion.

Celsius Network & Three Arrows Capital (3AC)

Celsius provided yields that seemed too good to be true, luring millions of users. Its ability to maintain these yields relied on risky ventures, notably its significant exposure to TerraUSD. This led to criminal charges against CEO Alex Mashinsky, who received a 12-year sentence for fraud and market manipulation. The Celsius debacle resulted in at least $1.7 billion in losses, along with an additional $4.7 billion in blocked customer funds.

Three Arrows Capital was a once-renowned hedge fund that offered substantial returns at its height. However, relying on a centralized entity proved disastrous, as 3AC’s excessive leverage on Terra/LUNA and other risky investments led to losses exceeding $3.3 billion.

Mt. Gox Hack and Collapse

Centralization failure: This takes us back to the 2011-2014 era of Mt. Gox.

As one of the first successful centralized crypto exchanges, Mt. Gox handled around 70% of all BTC transactions at its height. A hack caused Mt. Gox to lose about 850,000 BTC in user funds — a sum today that’s worth nearly $100 billion. While centralized exchanges have bolstered their security significantly in the decade since this incident, the monumental scale of the Mt. Gox disaster continues to resonate with those familiar with crypto history and the inherent risks posed by any centralized crypto entity.

These crypto instances merely scratch the surface. Numerous traditional financial disasters could have been prevented or at least alleviated through decentralization and transparency.

2008 Global Financial Crisis

As the housing market surged, some of the largest banks and financial institutions heavily invested in mortgage-backed securities, using extreme leverage to expand their risk exposure.

Then the entire structure collapsed, with firms deemed Too Big to Fail actually going under. Lehman Brothers, a key player in this tragedy, failed spectacularly, triggering a global panic that devastated economies worldwide, from Iceland to Greece and beyond. The crisis erased more than $10 trillion — that’s Trillion, with a T — in wealth.

Enron

Blockchains are fundamentally immutable public ledgers, providing a way for anyone to illuminate financial transactions over any chosen timeframe.

The collapse of Enron, a once-dominant U.S.-based energy titan, highlighted the perils of prioritizing greed over transparency. The firm employed numerous forms of complex accounting fraud to inflate earnings reports and conceal enormous debt. Once the truth emerged, Enron collapsed, falling into bankruptcy and erasing $74 billion in shareholder value.

Key Takeaways

We could continue listing examples (look up Thodex, Bitfinex, QuadrigaCX, as well as MF Global, Wells Fargo, Bernie Madoff, and other traditional financial disasters, all of which could have been avoided or at least reduced through decentralization). Ultimately, centralization and lack of transparency are formidable foes to fair commerce, posing a constant danger – not just a relic of the past, but a current threat to both society and your assets.

The core principle of crypto (and, by extension, finance in general) must remain clear: “Not your keys, not your coins.” When it comes to your assets, rely solely on yourself.

What does this imply for you as a BTC holder?

To begin with, scrutinize the fine print. Despite how secure major centralized firms may appear, it’s essential to weigh the risks of entrusting your assets to others.

An effective alternative to centralized exchanges and custodians is decentralized blockchains. These allow you to maintain exclusive access to your funds through private keys.

Moreover, a few decentralized options have begun to surface for those looking to earn yield on their BTC. An even smaller subset of decentralized blockchains and applications provide BTC investment options that offer returns in actual BTC.

Therefore, conduct your research. If you neglect to do so, years down the line you might find yourself grappling with a painful question: Why did I think disaster wouldn’t strike again?