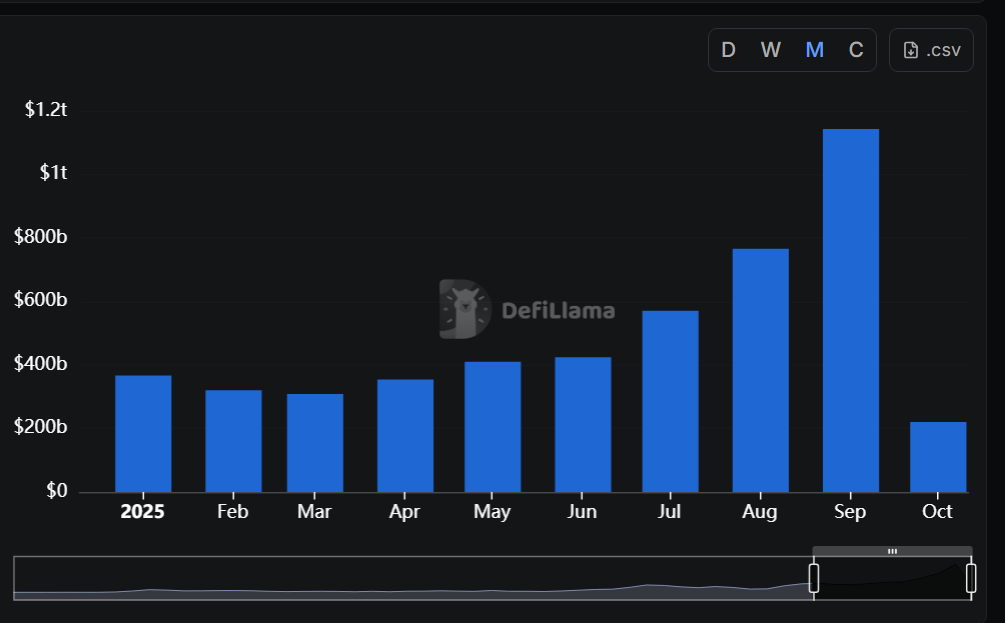

In September, Perp DEXs achieved a monthly trading volume exceeding $1 trillion for the first time, peaking at $1.14 trillion amid a surge in perpetual trading.

Summary

- In September 2025, trading volume on Perp DEXs crossed the $1 trillion mark, setting a historic record for the crypto sector.

- The surge in DEX trading continues, with many centralized exchanges adopting DEX features.

Based on data from DeFi Llama, perpetual decentralized exchanges recorded over $1 trillion in monthly trading volume for the first time ever in September 2025. This reflects a nearly 50% increase from the previous month, August, which was marked at $766 billion.

This increase in monthly trading volume was propelled by various decentralized protocols, including Aster (ASTER), Hyperliquid (HYPE), and Lighter, each surpassing the $150 billion trading volume threshold over the last 30 days. Just in the past week, perpetual trading saw a 161% rise.

Aster led the pack with a monthly trading volume of $493.61 billion, accounting for nearly half of September’s total perp trading volume. Hyperliquid followed with $280.7 billion, and Lighter ranked third with $165 billion in monthly trading volume.

In a short span of a month, Aster displaced Hyperliquid from its position as the leading market player in perpetual futures. Aster achieved in a few months what Hyperliquid took a year to do. In August 2025, analysts estimated Hyperliquid held 80% of the total perp trading market.

In the last 24 hours, Aster’s perp volume reached $80.47 billion, while Hyperliquid managed only $9.47 billion. The nearly 1000% disparity between the two protocols emphasizes Aster DEX’s swift ascent in the crypto landscape, bolstered by support from former Binance CEO Changpeng Zhao.

Perp trading on the rise

In comparison to September 2024, when perpetual futures trading volume was around $131 billion, it has skyrocketed to over $1 trillion in just one year, thanks to innovations in the field.

The rise in perpetual trading can be linked to the introduction of numerous features by platforms like Aster and Hyperliquid. Many Perp DEXs leverage high-throughput chains or Layer-2 solutions, which reduce latency, lower gas fees, and improve execution speeds.

Consequently, the obstacles that previously made derivatives trading less appealing on-chain have been significantly reduced.

Another significant factor is the reward models initiated by DEXs to draw in more users for trading on their platforms. An increasing number of protocols are implementing token incentives, yield-sharing methods, revenue distributions, and “point-farming” schemes to boost volume and liquidity on their platforms.

Projects like Aster have heavily relied on such incentive strategies to rapidly enhance trading activity and gain user traction.

Additionally, centralized exchanges such as OKX are beginning to incorporate DEX trading support, aiming to attract more users through a hybrid approach that merges CEX and DEX functionalities. Currently, the program is in a limited public beta test phase.

As per the announcement, the exchange aims to distribute 1,000 experience codes globally, allowing users to test the DEX support feature without incurring trading fees. Transactions will be executed directly within the OKX exchange interface.