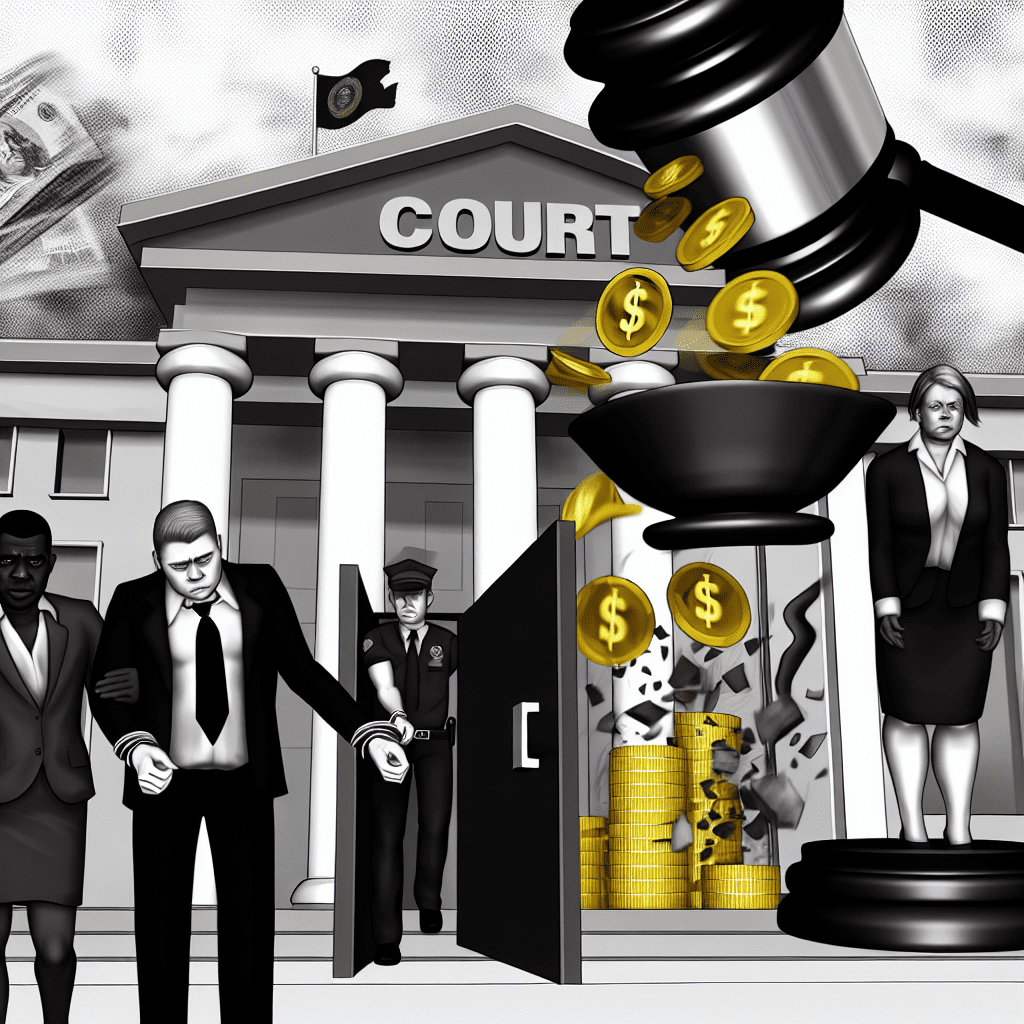

Two ex-executives from the now-defunct crypto lender Cred LLC have been sentenced to a total of 88 months in federal prison for their involvement in a wire fraud scheme.

Summary

- Former Cred CEO and CFO sentenced to 88 months for defrauding over 6,000 customers of $140 million

- Executives misled clients following the COVID-19 crash, which revealed Cred’s risky business model

- Cred’s bankruptcy has resulted in over $1 billion in losses based on current crypto valuations

The conspiracy has left more than 6,000 customers facing losses exceeding $140 million.

Senior U.S. District Judge William Alsup sentenced co-founder and former CEO Daniel Schatt to 52 months, while former CFO Joseph Podulka received a 36-month sentence.

Cred Executives Pleaded Guilty in May

Both defendants entered guilty pleas in May to charges of wire fraud conspiracy linked to their misleading practices at the San Francisco-based crypto lending platform.

The sentences conclude a protracted legal battle that commenced with Cred’s bankruptcy filing in November 2020.

Using cryptocurrency valuations as of August, the government estimates that customer losses surpass $1 billion, marking it as one of the most significant failures in crypto lending history.

Cred functioned as a financial services provider in the cryptocurrency space, offering dollar loans secured by crypto collateral and accepting deposits from customers in return for promised yield payments.

The company’s business model heavily depended on partnerships with foreign entities, which prosecutors assert customers were largely unaware of.

The fraudulent scheme began in March 2020, triggered by market upheaval from COVID-19 that led to a sharp drop in Bitcoin prices.

This situation revealed critical weaknesses in Cred’s risk management approach and paved the way for the executives’ subsequent misleading actions.

COVID Crash Exposed Cred’s Risky Business Model

The March 2020 crypto market setback significantly impacted Cred’s operations. Days after the Bitcoin (BTC) price declined, the company was informed by its hedging partner that it was financially compromised and needed to liquidate all trading positions immediately.

This hedging relationship, intended to shield Cred from price fluctuations, ended suddenly, leaving the company with no safeguards against future market volatility and exposing customers to risks they were unaware of.

To complicate matters, Cred learned that a Chinese firm it depended on to generate customer yields was unable to repay tens of millions. Instead of revealing these escalating financial issues, Schatt and Podulka actively misled customers regarding the company’s well-being.

During a public “Ask Management Anything” session on March 18, 2020, Schatt reassured customers that Cred was “operating normally,” despite knowing the dire financial circumstances.

Both executives are also required to serve three years of supervised release and pay a $25,000 fine.