Crypto markets have regained momentum in the last 24 hours, with the market cap of ‘made in USA’ coins increasing by 7%. This rebound follows Jerome Powell’s remarks at Jackson Hole, where the Fed Chair adopted a notably dovish stance, recognizing escalating risks in the labor market and indicating a willingness to consider rate cuts in September.

While no definitive promises were made, the anticipation of easing has already buoyed major assets, although the reaction among tokens has varied. In this context, there are three made in USA coins to monitor ahead of September rate cuts that could trigger the next wave of liquidity.

XRP (XRP)

XRP is currently trading near $3, having risen 6.5% in the past 24 hours, yet its increase is modest when compared to Ethereum and Solana. This underperformance indicates that September rate cuts may not be fully incorporated into its pricing, positioning XRP as a coin to monitor ahead of those potential cuts.

The daily chart shows the Chaikin Money Flow (CMF) trending upward, indicating stronger inflows, with the Relative Strength Index (RSI) at about 49—indicating a neutral position, suggesting that the token isn’t approaching overbought levels.

The Chaikin Money Flow (CMF) gauges buying and selling pressure through price and volume, where higher values indicate stronger buying activity.

Conversely, the Relative Strength Index (RSI) assesses the pace and change of price movements to measure momentum, with scores above 70 indicating overbought conditions and below 30 as oversold.

Holding above $3.10 improves the likelihood of a rise to $3.34, while a break through that barrier could trigger a stronger ascent past $3.65. A decline below $2.78, however, poses the risk of greater losses.

Beyond price, the fundamentals are significant. Ripple achieved a legal milestone by having its SEC appeal dismissed, and several amended XRP ETF filings have reignited speculation about institutional influxes.

These elements collectively prepare XRP for a potential sharp response if September rate cuts are confirmed.

Interested in more insights like this? Subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter here.

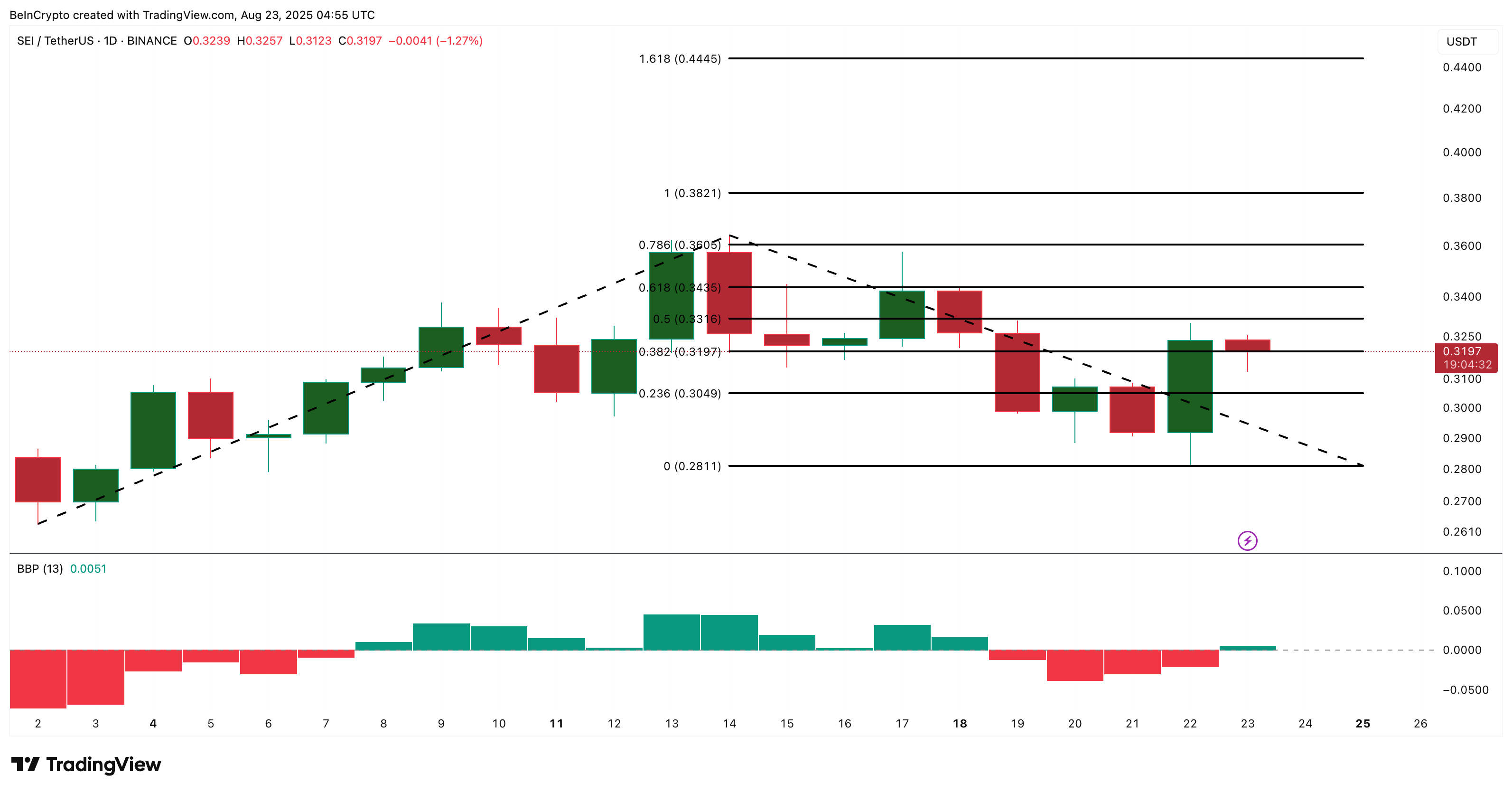

Sei (SEI)

SEI Network, a US-created Layer-1 platform for trading applications, has quietly risen in prominence in recent months. Ondo Finance’s move to launch tokenized treasuries on SEI underscores its importance in the real-world assets landscape.

The token has surged nearly 10% in the last day, now priced at $0.31. It appears that bulls have regained control after four days of waning momentum.

This turnabout has been validated by the bull-bear power indicator transitioning to green, further solidifying SEI’s position among coins to monitor prior to September rate cuts.

Bull Bear Power (BBP) illustrates the equilibrium between bullish and bearish momentum, with rising green bars indicating bullish dominance.

In a three-month period, SEI has posted gains of 44%, maintaining an upward trend. Fibonacci projections suggest resistance exists between $0.33 and $0.36, and a breakout could pave the way to $0.44.

If it dips below $0.30 and $0.28, the bullish setup would weaken. With the overarching sentiment leaning dovish, SEI’s restrained rally offers room for acceleration should liquidity increase in September.

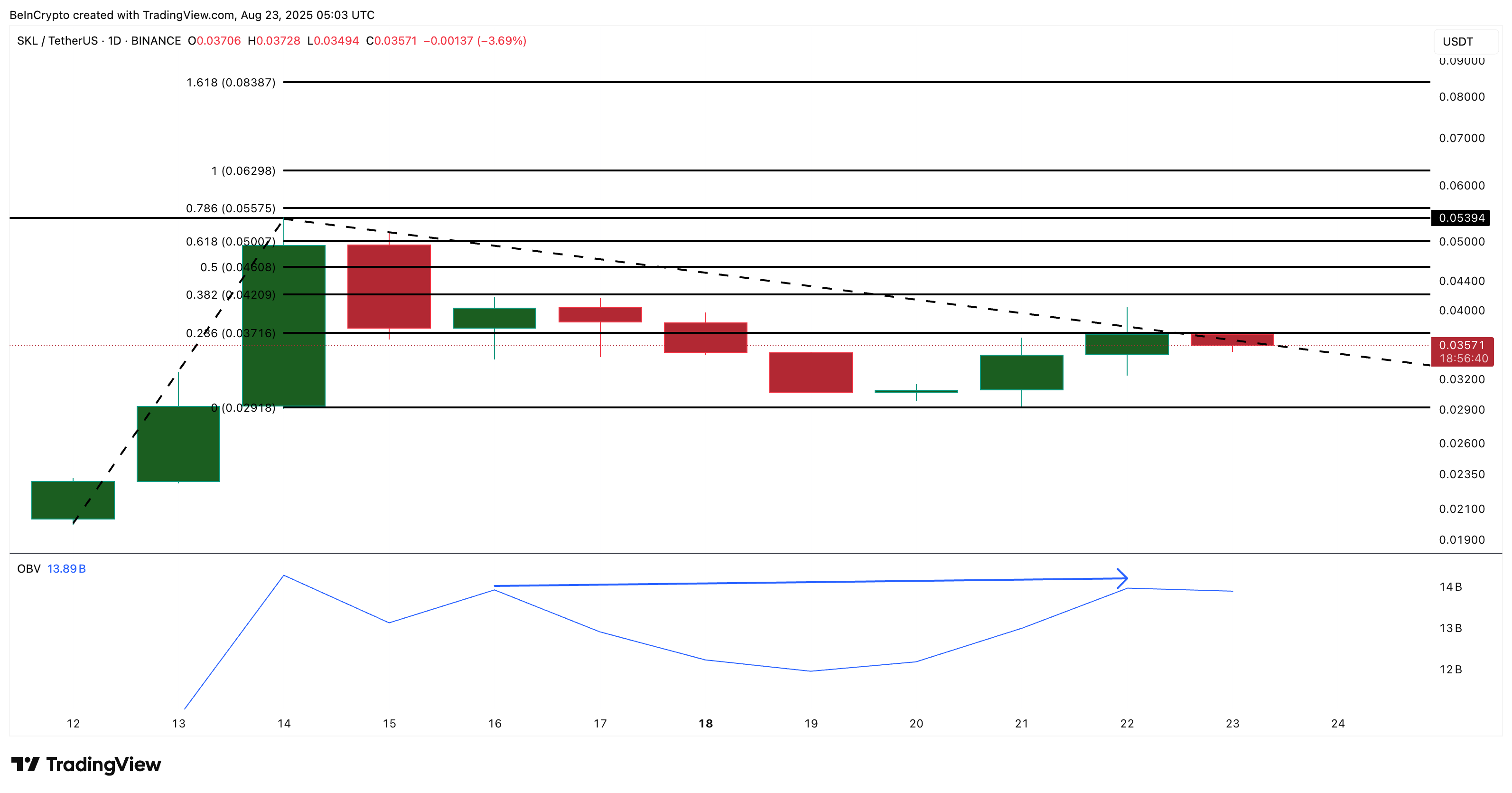

SKALE (SKL)

SKALE, a US-based Ethereum scaling solution, has attracted attention following a 50% spike earlier this month fueled by whale activities and speculation over a potential Google partnership.

Although the price has stabilized, it trades consistently around $0.035, with daily gains under 5%. The broader trend indicates that buyers are gradually re-emerging.

On-balance volume increased from 13.93 billion on August 16 to 19.98 billion on August 22, even as prices peaked lower. This indicates that accumulation is in progress. Netflow data also reflects persistent outflows, suggesting that selling pressure is decreasing.

On-Balance Volume (OBV) adds volume on positive days and subtracts it on negative days to ascertain whether buyers or sellers are driving the trend.

Key levels to note are $0.037 and $0.055, with a confirmed breakout above $0.055 allowing for minimal resistance up to $0.083.

As September rate cuts are anticipated to introduce liquidity into risk assets, SKALE’s strengthening technicals and project significance in Ethereum scaling render it one of the most intriguing coins to observe before these cuts.

However, falling below $0.029 could nullify the bullish perspective, setting the stage for further lows in SKL’s price.

Overall, these three ‘made in USA coins’ demonstrate significant volatility as they await potential September rate cuts.

The post 3 Made In USA Coins To Watch Before September Rate Cuts appeared first on BeInCrypto.

(@FilanLaw)

(@FilanLaw)