Reports indicate that Ripple is venturing into corporate treasury services with a $1 billion acquisition. This purchase, associated with a treasury management firm, has encouraged some market commentators to propose bold price scenarios for XRP, including an ambitious prediction of over $1,000.

Related Reading

Ripple Enters Corporate Treasury

A cryptocurrency educator known as “X Finance Bull” has outlined a series of potential price milestones. According to his analysis, investors could see XRP trading around $2 to $3 in the short term, moving to $5–$10 over a more extended period, and potentially reaching $20–$100+ during a bullish phase.

The educator also suggests a theoretical peak of over $1,000 if XRP captures a significant portion of corporate treasury flows. These projections are being circulated widely, often lacking the necessary qualifiers to temper expectations.

🚨THIS IS WHERE IT BEGINS! 🚨 $XRP is on the verge of going parabolic to $1,000 and beyond!

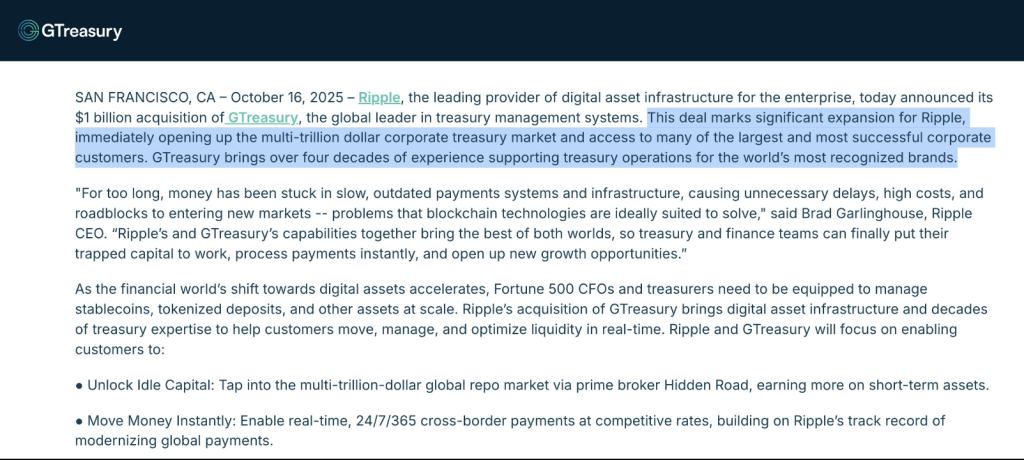

Ripple has just acquired GTreasury for $1B

This is a domino effect that triggers the largest capital flow event in crypto history

Be sure to BUY every dip of $XRP!

Here’s what many are overlooking 🧵👇 pic.twitter.com/6qs5KjKWgp— X Finance Bull (@Xfinancebull) October 16, 2025

Significance of the Move

The rationale for this optimistic scenario is relatively clear. If Ripple integrates its software and token into the treasury operations of major corporations, the demand for on-ledger liquidity is likely to surge.

Corporations that manage cash, currency exchanges, and liquidity typically handle substantial amounts of money. Market participants note that harnessing these flows can significantly alter adoption dynamics for a token. However, widespread adoption, legal clarity, and genuine usage trends must align for token prices to experience significant increases.

Optimistic Projections and Data

Proponents argue that the $1 billion deal signifies Ripple’s recognition of enterprise potential. They contend that treasury clients may require rapid settlement options and that XRPL functionalities could seamlessly integrate into these processes.

The educator’s predictions feature precise ranges: $2 to $3 in the early phase, $5–10 in the mid-phase, and $20–$100+ later. However, these ranges assume widespread corporate adoption and token demand trends that have yet to be established.

Market valuations implied by a $1,000+ XRP would vastly exceed current totals unless the circulating supply diminishes or new economic models are introduced.

Related Reading

Regulatory Considerations

Regulatory factors play a crucial role. Courts and regulators are clarifying the treatment of tokens across different jurisdictions, and these regulations will influence institutional interest.

Integration specifics are equally significant: how the token is utilized within treasury software, whether firms choose to hold or merely process XRP, and how custody and risk management adapt to tokenized liquidity.

Each of these elements could either facilitate price growth or render the token’s value peripheral to enterprise functions.

Featured image from Unsplash, chart from TradingView